As the financial markets continue to evolve, traditional investment strategies are being challenged by new, more dynamic approaches. One such strategy that’s gaining significant attention is Swing Trading and Momentum Investing. If you’re looking to stay ahead of the curve, these methods can offer a forward-thinking way to navigate the ever-changing market landscape.

The Changing Dynamics of the Market

For decades, investors relied on long-term, value investing strategies, focusing on buying and holding stocks of well-established companies. However, in today’s fast-paced markets, this approach may no longer provide the returns that investors once enjoyed. Even blue-chip stocks that were once considered stable have faced significant declines from their peak values.

Take a look at some examples:

- RIL (Reliance Industries) is down 25% from its peak.

- Asian Paints has fallen 32%.

- Avenue Supermart (D-Mart) is down by 37%.

- Tata Motors has dropped 38%.

- HUL (Hindustan Unilever) is down by 25%.

- Tata Steel has fallen 23%.

- Bajaj has lost 30%.

These declines highlight that even the most trusted companies can be vulnerable in the current market environment. Investors relying solely on long-term growth through traditional investing methods might find themselves frustrated with the slow recovery of these stocks.

Enter Swing Trading and Momentum Investing

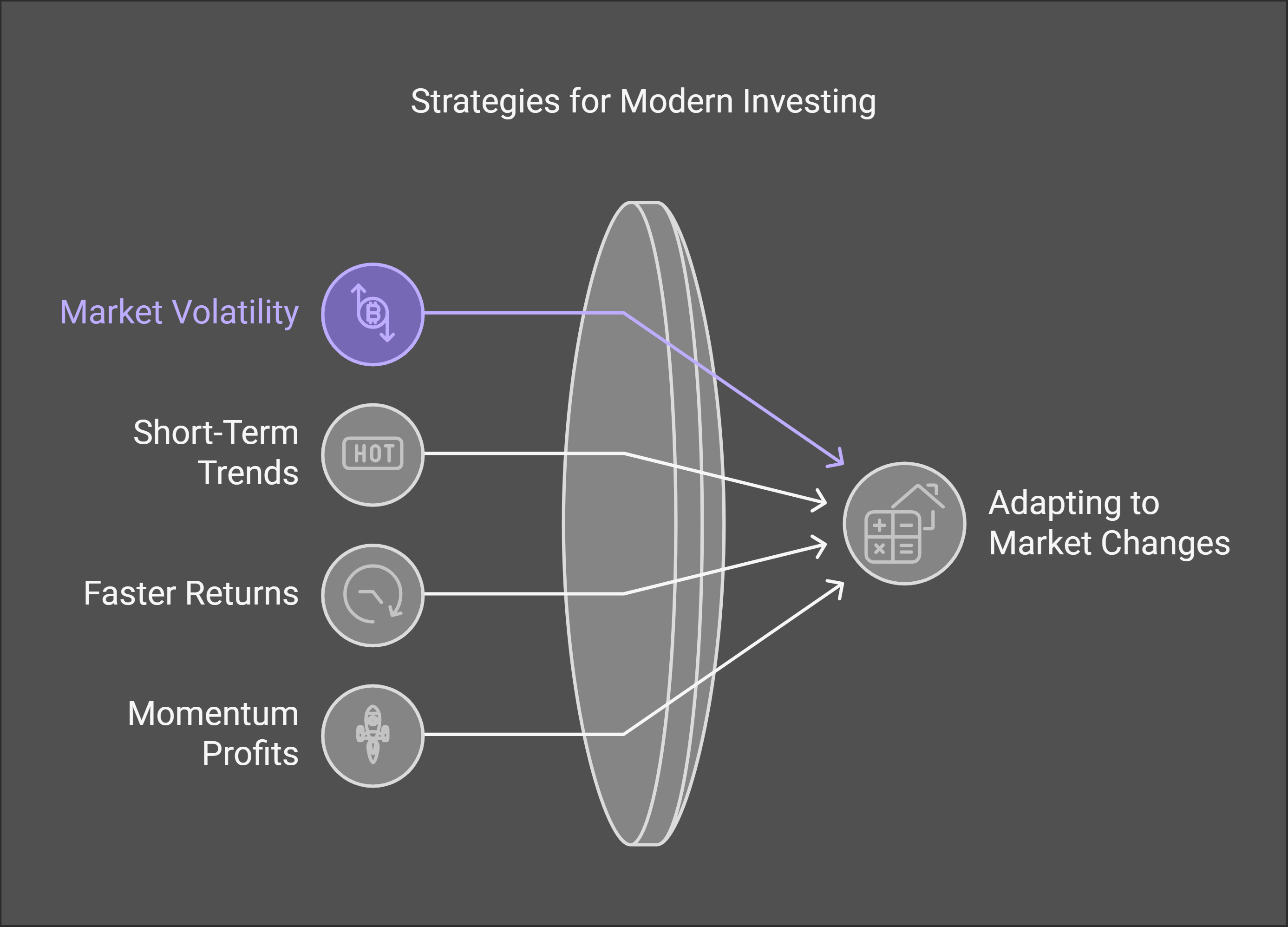

This is where Swing Trading and Momentum Investing come in. These strategies focus on taking advantage of short-term market trends and price movements, enabling traders to capitalize on the market’s natural ebbs and flows. Unlike traditional investing, which focuses on long-term holding, swing traders enter and exit positions based on shorter-term trends, making profits even during volatile market periods.

Why Swing Trading and Momentum Investing Make Sense

- Adaptability to Market Volatility: Today’s market is full of unpredictability. Economic shifts, geopolitical events, and global crises can send stock prices on wild rides. Swing trading allows you to move with the market, making quick, calculated moves to profit from these fluctuations.

- Faster Returns: Unlike traditional investing, which may require years to see significant returns, swing trading can provide faster profits. By taking advantage of short-term trends, you can capitalize on quick price movements and compound your gains over time.

- Reduced Risk of Long-Term Stagnation: Holding onto stocks for years, especially in a market downturn, means taking on significant risks. Swing trading offers an opportunity to stay agile, avoiding losses in long-term stagnant stocks, and enabling you to invest in opportunities that can offer quicker turnarounds.

- Momentum-Based Profits: Momentum investing focuses on stocks or sectors that are currently experiencing upward trends. By identifying these stocks early on, traders can profit as these momentum plays continue to rise, capitalizing on the market’s positive movements.

Why This Strategy is the Future

The market is becoming increasingly fast-paced, and swing trading and momentum investing are perfectly suited to this dynamic environment. These strategies are actively managed, meaning you’re not just hoping for long-term growth but reacting quickly to market movements. As more investors recognize the importance of agility and short-term gains, momentum investing is expected to rise in popularity.

If you’re looking for a strategy that adapts to market changes, capitalizes on short-term movements, and offers faster returns, swing trading and momentum investing are the way forward. These methods will allow you to navigate market shifts with precision and skill, making your investment journey both more rewarding and more efficient.

Join Our Telegram Channel for Expert Insights

If you’re ready to take the next step and explore swing trading and momentum investing more in-depth, join our Telegram channel. We’ll provide you with expert tips, strategies, and real-time market insights to help you make the most of these trading strategies. Stay ahead of the curve, adapt to the market’s changes, and learn how to capitalize on momentum to secure consistent profits.

Start your journey today and embrace the future of investing with Swing Trading and Momentum Investing!

Equidote Official

Market Research and Analysis from Renowned SEBI registered Analyst.

– Daily Market View

– Sector and Stocks in Focus

– Levels of Index

– View on F&O stocks having momentum

– Educational Seminar

Subscription fees NIL

Telegram Channel Name : EQUIDOTEOFFICIAL