The Age of Platform Businesses and AI, combined with the rapid pace of digitalization, presents significant investment opportunities. As digital technologies become the backbone of business growth and transformation, the demand for data centers and associated infrastructure continues to rise. Investors have an opportunity to capitalize on this mega-trend through strategic investments across various sectors tied to platform businesses, AI, and the data center ecosystem.

Here’s how the investment theme plays out across the different areas:

1. Investing in Platform Businesses and AI

Platform businesses and AI-driven companies are central to the next phase of technological and economic growth. These businesses create scalable ecosystems that leverage data, network effects, and AI to enhance value for users and stakeholders.

Investment Opportunities:

- Public Equities: Investing in publicly traded companies that are leading the platform economy, such as Amazon, Google, Facebook, Uber, and Alibaba, provides exposure to the growth of these platforms. These companies are at the intersection of AI, big data, and digital business models.

- AI Startups: Private equity and venture capital investors can target AI startups that are developing cutting-edge technologies for sectors like healthcare, finance, logistics, and customer service. Companies developing AI solutions for automation, machine learning platforms, or AI-driven software applications are prime targets for growth.

- E-commerce & Fintech: E-commerce platforms and fintech companies are major beneficiaries of the platform business model. Investing in companies like Shopify, Stripe, or Square allows investors to gain exposure to the digital payments and online commerce boom, which is directly tied to platform business models.

- AI Software and Infrastructure Providers: Companies that provide AI infrastructure, such as NVIDIA (which produces GPUs for AI computation) or Microsoft (with Azure AI), are benefiting from the growing AI trend. These companies supply the tools and platforms that support AI innovation across industries.

- AI ETFs and Funds: Investors seeking diversified exposure to AI and platform businesses can invest in exchange-traded funds (ETFs) and mutual funds that focus on AI, cloud computing, or tech infrastructure.

2. Investing in Data Centers: The Backbone of Digital Transformation

Data centers are the physical infrastructure supporting the rapid growth of platform businesses and AI technologies. With the continued digitalization of industries, demand for data storage, processing, and cloud services is expected to skyrocket. Data centers are crucial in supporting cloud computing, AI workloads, and vast amounts of user data that power modern platforms.

Investment Opportunities in Data Centers:

- Real Estate Investment Trusts (REITs): Data center REITs are an ideal way for investors to gain exposure to the growing demand for data center infrastructure. REITs like Digital Realty and Equinix invest in, develop, and operate data centers globally. These companies often offer stable, long-term dividends, making them attractive to income-focused investors.

- Private Equity & Venture Capital: Investors looking to take on more risk and achieve higher returns can target private equity or venture capital funds that invest in data center startups or emerging markets in the data center space. For example, CoreSite or Switch are private companies that could be potential targets for investment.

- Direct Investment in Data Center Development: For institutional investors or high-net-worth individuals, direct investment in data center development is an option. This can involve backing the construction and expansion of data centers in regions with growing cloud demand, such as North America, Europe, and parts of Asia.

- Cloud Infrastructure Providers: Investing in cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, or Google Cloud provides indirect exposure to data centers. These companies own and operate massive data center infrastructures that power cloud services and AI solutions, and they are integral to the ongoing digital transformation.

3. Rapid Pace of Digitalization and the Opportunities it Brings

Digitalization is driving global economic change by transforming industries, creating new business models, and expanding digital connectivity. With the rapid pace of digital transformation, there are ample opportunities to invest in the enabling technologies and infrastructure.

Investment Opportunities in Digitalization:

- Cloud Computing & SaaS (Software as a Service): As more businesses migrate to the cloud, there is an increasing demand for cloud computing services. Investing in cloud leaders like Amazon (AWS), Microsoft (Azure), or Salesforce provides exposure to the digitalization of business operations and the shift to subscription-based software models.

- 5G and Edge Computing: 5G is expected to drive significant growth in data usage, mobile applications, and IoT devices. Edge computing, which processes data closer to where it’s generated, is an important trend for the future of AI, IoT, and real-time data processing. Companies like Qualcomm, Nokia, Ericsson, and Cloudflare are at the forefront of this transformation and present investment opportunities.

- Cybersecurity: As digitalization accelerates, cybersecurity becomes increasingly critical. Companies providing cloud-based security, AI-driven threat detection, and data privacy solutions are key to the digital future. Companies like CrowdStrike, Palo Alto Networks, and Zscaler are leaders in the cybersecurity space and attract investors seeking to capitalize on the growing need for secure digital environments.

- IoT Companies: The Internet of Things (IoT) is a rapidly growing sector driven by the need for interconnected devices, sensors, and smart systems. IoT will create massive data streams, which in turn will require data centers for processing. Companies involved in developing IoT devices, like Qualcomm, Cisco, or GE, present attractive opportunities.

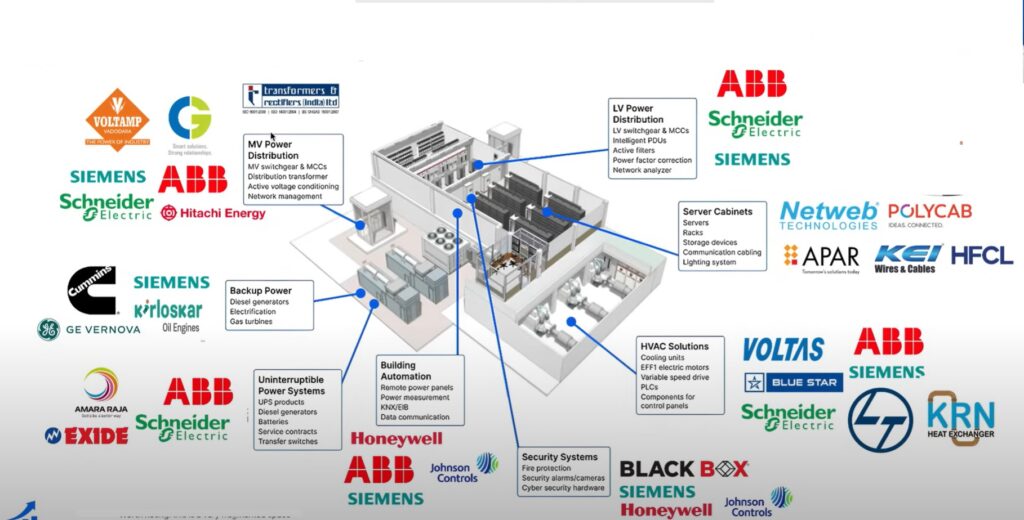

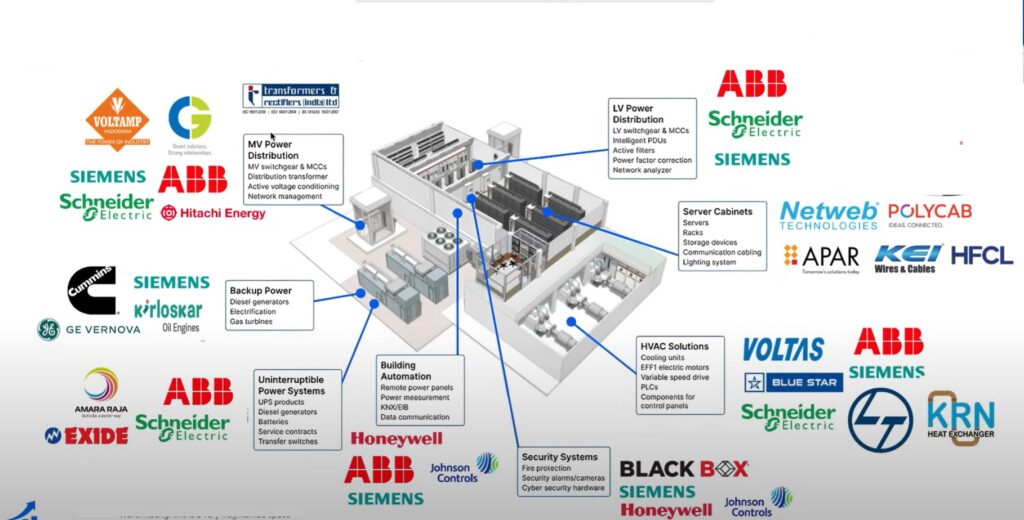

4. Value Chain of the Data Center Ecosystem: Investment Themes

The value chain of the data center ecosystem offers a diverse range of investment opportunities, from the design phase through to the operation and development of data centers. Below are several investment themes across the value chain:

Investment Opportunities in Data Center Ecosystem:

- Design & Engineering:

- Engineering Firms: Companies that provide specialized engineering services for data center design and architecture are poised to benefit from the expansion of the digital infrastructure. Investing in companies like AECOM or Jacobs Engineering offers exposure to the planning and design of data centers.

- Design Software Providers: Companies offering specialized design software for data centers, such as Autodesk, benefit from increased demand for digital infrastructure design.

- Data Center Infrastructure (Infra):

- Hardware Providers: Companies that manufacture the servers, cooling systems, power supplies, and networking hardware used in data centers are integral to the ecosystem. Firms like Cisco, Intel, NVIDIA, and Schneider Electric are positioned to benefit from the growing demand for more advanced and efficient infrastructure.

- Power Providers: Data centers are energy-intensive operations. Companies focusing on renewable energy and power-efficient technologies, such as NextEra Energy, Siemens, or Enel, are essential in supporting the growth of sustainable data centers.

- EPC (Engineering, Procurement, and Construction):

- Construction Firms: Large-scale data center construction projects require specialized contractors with experience in high-tech infrastructure. Investing in firms like Fluor Corporation or Bechtel that handle large infrastructure projects can provide exposure to the data center building boom.

- Operators & Developers:

- Data Center Operators: Companies like Equinix, Digital Realty, and CyrusOne operate and manage data centers, benefiting from long-term contracts and increasing demand for cloud storage and processing power.

- Developers: Direct investments in data center developers or private equity firms involved in the creation and scaling of new data center facilities provide high potential for growth. Companies like Iron Mountain or QTS Realty Trust are significant players in the development space.

Conclusion: A Multi-Dimensional Investment Theme

The intersection of platform businesses, AI, and data centers represents a rich and multi-dimensional investment theme. As these trends continue to accelerate, investors can look to capitalize on the following:

- Public and private equity investments in platform businesses and AI-driven companies.

- Infrastructure investments in data centers through REITs, private equity, and direct investments.

- Exposure to the broader digital transformation space through cloud computing, cybersecurity, and IoT companies.

With the rapid pace of digitalization reshaping the global economy, investors who identify and invest early in these key themes can position themselves to benefit from the growing demand for digital infrastructure, AI capabilities, and the expansion of platform-based business models.

SOURCE : SMC GLOBAL ; INFORMATION SHARED IS ONLY FOR EDUCATIONAL PURPOSE

Equidote Official

Market Research and Analysis from Renowned SEBI registered Analyst.

– Daily Market View

– Sector and Stocks in Focus

– Levels of Index

– View on F&O stocks having momentum

– Educational Seminar

Subscription fees NIL

Telegram Channel Name : EQUIDOTEOFFICIAL