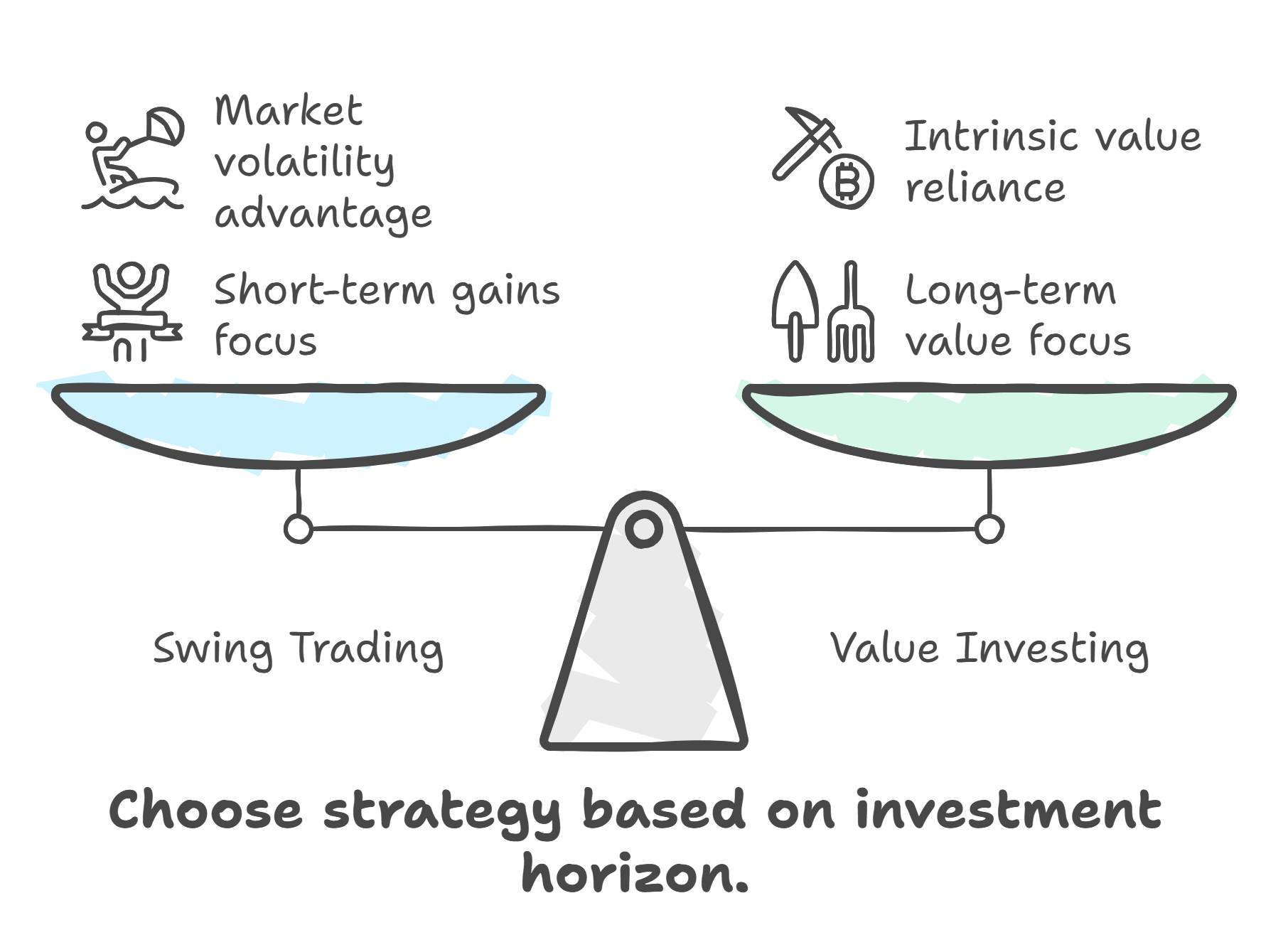

The decision between swing trading, momentum investing, and value investing depends on an investor’s goals, risk tolerance, time horizon, and market outlook. While value investing has a long-standing track record of success (thanks to investors like Warren Buffett), swing trading and momentum investing can be advantageous in certain market conditions or for investors with specific strategies. Below are some reasons why swing trading and momentum investing might be considered better than value investing in certain situations:

1. Faster Returns

- Swing trading and momentum investing focus on short- to medium-term price movements. Traders seek to capitalize on price fluctuations within weeks or months, potentially leading to faster returns compared to value investing, which typically takes years to realize the value of investments.

- Value investing often requires waiting for the market to recognize a company’s intrinsic value, which can take time. This long-term approach may be less attractive for those seeking quicker profits.

2. Adaptability to Market Trends

- Momentum investing thrives in trending markets, where assets exhibit strong and sustained movements in one direction (either up or down). Investors can follow trends and ride them for as long as possible, capitalizing on positive momentum.

- Swing trading can also take advantage of smaller, shorter-term market movements, aligning well with volatile or range-bound markets where stocks go through predictable price swings.

- Value investing is typically less suited for such environments, as it focuses more on the fundamentals and less on short-term price movements.

3. Less Dependence on Intrinsic Value Analysis

- In value investing, much time and effort are spent on analyzing a company’s fundamentals (earnings, balance sheets, etc.) to determine its intrinsic value. This can be a lengthy and complex process.

- Swing trading and momentum investing, on the other hand, rely more on technical analysis, chart patterns, and market sentiment. They don’t require as much in-depth fundamental analysis, making them easier for those who prefer a quicker approach.

4. Capitalizing on Volatility

- Both swing trading and momentum investing are better suited to capitalize on market volatility. For example, during periods of high volatility, stocks can move sharply in one direction or another, providing swing traders and momentum investors opportunities for profits in shorter time frames.

- Value investing generally works best when the market is stable or undervalued assets are being mispriced over the long term. In volatile markets, value investors may struggle to hold their positions, especially if the market overlooks the value for an extended period.

5. Reduced Time Horizon and Active Engagement

- Swing traders can take advantage of trends and momentum without needing to commit to long-term investments. This can be beneficial for individuals who have the time, interest, and expertise to actively manage their portfolio, often making frequent adjustments.

- In contrast, value investing typically requires investors to adopt a more passive, long-term approach, often necessitating patience and commitment to a stock or asset for many years, which can be challenging for some.

6. More Opportunities in Trending Markets

- Momentum investing works well when there are strong bull or bear markets, where stocks or other assets show consistent upward or downward movement. This can lead to more opportunities to profit from short-term trends compared to value investing, which requires patience for the market to recognize the value of a stock.

- During periods of market exuberance (bull markets), momentum investors may have an edge because they can ride the wave of investor enthusiasm.

7. Flexibility

- Swing traders and momentum investors can diversify their strategies by using a mix of assets like stocks, options, commodities, and currencies. This diversification can help reduce risk and create multiple income streams.

- Value investing typically focuses on stocks with a strong value proposition and may not take full advantage of other asset classes or market inefficiencies that short-term strategies can exploit.

8. Opportunities in Both Bull and Bear Markets

- Momentum investors can capitalize on both upward and downward momentum in the markets. They can trade on rising stocks or short sell stocks in a downtrend.

- Swing trading also allows for profiting from both rising and falling prices, depending on market conditions.

- Value investing is more focused on identifying undervalued stocks that will eventually rise, which might not yield benefits in a prolonged bear market unless the investor is prepared to hold on for a long time.

9. Increased Liquidity

- Since swing trading and momentum investing typically involve shorter holding periods, they offer higher liquidity. Traders are frequently buying and selling, which ensures they can exit positions and free up capital faster.

- Value investing involves holding positions for longer periods, which can sometimes lead to less liquidity, especially in illiquid or niche stocks.

10. Psychological Benefits for Active Traders

- Some traders prefer the active nature of swing trading and momentum investing, as they enjoy the excitement of making frequent trades and profiting from shorter-term movements. This can be a more engaging and satisfying approach compared to the long, patient waiting required in value investing.

- On the other hand, value investing can require strong emotional control, as it may take years to see positive results, which can be frustrating for those looking for faster rewards.

Equidote Official

Market Research and Analysis from Renowned SEBI registered Analyst.

– Daily Market View

– Sector and Stocks in Focus

– Levels of Index

– View on F&O stocks having momentum

– Educational Seminar

Subscription fees NIL

Telegram Channel Name : EQUIDOTEOFFICIAL